If you watch the US markets in any sense, you know that Amazon is a powerhouse of a company that has successfully penetrates numerous markets as a part of an “internet of things” revolution. Throughout the world, brick and mortars shops fell asleep at the digital revolution, in which shopping experienced a virtual transformation. As someone who owns AMZN stock, this has been both wonderful and frustrating. Wonderful because I’ve made a lot of money; frustrating because I studied Amazon enough to know this isn’t surprising. Amazon’s core advantage is its supply chain management. Amazon can ship quickly and cheaply, and that allow them to discount their products heavily. You add strong customer service and you have a enormous company that continues to grow year after year.

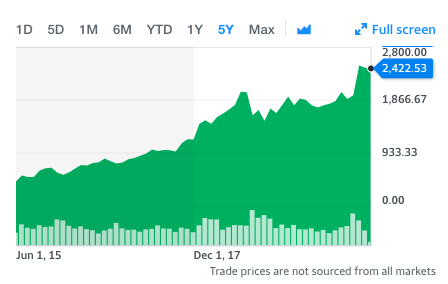

I invested late into AMZN, buying at roughly $1,500 a share. That was when people were shocked at it’s growth, and there was considerable discussion about “reaching their limit”. They are currently sitting at $2,400 and I’ve realized (to date) a 50% gain. All that being said, I feel like the same transformation is (or will) take place in China. And in that sense, I seriously looked at eastern equivalents of AMZN. When people say the “Amazon of China”, they typically think of Alibaba (BABA).

This is a little misleading because Alibaba and Amazon aren’t really equivalents. Alibaba engages heavily in B2B sales, where Amazon is heavily focused on consumers. Also, head over to Alibaba and try to buy something. It’s an entirely different experience. It’s not about cool gadgets or gizmos, it’s about bulk sales. Large quantities, heavily discounted. To me, the most attractive aspect of an Alibaba is its leadership – Jack Ma. This goes back to a age old lesson taught to me in my venture finance classes. In any investment opportunity, 3 factors contribute heavily to success:

- Character Risk

- Management Team Risk

- Commercialization Risk

Character risk involves the integrity and trustworthiness of the management team. Management team risk is the greatest single attribute to the success of the new venture. Both Venture Capitalists and Angel Investors most important criteria for the success of the new venture involve the management team. Management team risk accounts for the success or failure of past start-up ventures, industry expertise, technology expertise, management expertise, as well as financial expertise. These factors can be complimented by an advisory board, but the quality of the management team is arguably the most important factor concerning the success of the new venture. Commercialization risk is composed of Development Risk, Customer Acceptance Risk, and Sales and Market Risk.

In this case, Jack Ma would be the greatest influencer of success or failure, and Jack commands a strong history of successful startups. All of this convinced me Alibaba would be the front runner as the “Amazon of China.” Like Amazon, perhaps I could invest and ride a wave of prosperity. In the end, I had an issue that caused me to hesitate. Why is Alibaba listed on the NYSE? It’s a heavily Asian centric company? Isn’t that a little weird? More so, what voting rights would I have? What would stop Alibaba from “vanishing”, in the spirit of conspiracy theories of gross fraud.

That caused me to wait. And while I waited, the money poured in. Alibaba became the “Amazon of China”, ready to take over the world. Except one day, Jack Ma announced he was leaving Alibaba – to teach…? Back to venture finance 101. Any credible investor knows that this represents huge risk. You have a credible management team, and the force which achieved success is stepping back.

At some point, I felt like the upside outweighed the downside. Amazon’s growth continues to accelerate and waffling over Jack Ma and proxy issues while Alibaba grew and grew and grew was a losing proposition. In the end, I bought Alibaba near $200 a share, and it was a wild ride.

Shares shortly dropped to $160 when Trump increased his rhetoric against China concerning a trade war. And even though Alibaba’s management team justified their growth with the fact that the vast majority of sales were internal to China – meaning a trade war would do almost nothing to bottom line sales, the stock continued to decline. At one point, I remember overhearing conversations about how the “trade war” with China would destroy the United States cheap, consumer market. This type of rhetoric deeply affects companies such as Walmart, Amazon, and others who profit heavily upon selling cheap consumer goods made in Asia. In the end, I was frustrated, so I sold my shares at a slight loss. At one point it went $220 but remains at $200 even during the coronavirus pandemic. All of this being said, I’m not optimistic for Alibaba’s future. And this brings me to another point.

My middle child is notorious for lying. She’s passive-aggressive, and oftentimes I’ll find things destroyed around the house after she’s been scolded. Whenever I ask her if she did it, I get this weird half-laugh, complimented with big, puppy-eyes – no it wasn’t me response. The problem is, there have been times where I found something destroyed, accused her of doing it, and later found out that it was her siblings. This is a huge The Boy Who Cried Wolf problem. And it makes me feel bad, because lying has created a scenario where there is no integrity. I can’t trust her, even if she’s right OR wrong. It doesn’t even matter anymore. This is so frustrating! Can you tell that I’m frustrated?

Okay, back to investing. Some time ago, this thread appeared on reddit investing. Go ahead, read the comments. Luckin Coffee. It’s like Starbucks. The discussion goes on. One person dropped “$5k” into it. And then you get these kind of comments:

And this is just a representation here. There was also a Twitter thread on Luckin Coffee where several people (who lived in China) said it was a complete fraud. That they had no consumers, and it’s just China subsidizing the company. Okay? To an investor, what kind of comment is that? That’s like trying to buy a car when someone tells you the car doesn’t actually have an engine, and walks away. Except these folks were right. It turns out, the CEO and COO committed massive financial fraud, and the stock plummeted and received notice from the NASDAQ about potentially being delisted.

Except, ironically, the stock surged ~50% today over rumors of a buy-out. (Robinhood traders are alive!) My issue is this. How do I know it’s even worth half of that? What assets does Luckin Coffee have? How much capital? And more importantly, how do I even know if I can trust those figures? This goes back to Venture Finance. But it’s not only Management Team Risk, it’s Character Risk. And Character Risk is the biggest gaping black hole in the success and integrity of a growing business.

How does all this connect with Alibaba? I love local business. I think localized supply chains are efficient and sustainable. And I love helping businesses that I can interact with and purchase from. Alibaba is has a nagging Management Team Risk, and the company is so far removed from the United States economy. Just like Amazon has struggled to penetrate the Asian markets, I think Alibaba will struggle to move beyond the Asian B2B market. And to be honest, I’m still rattled by Luckin Coffee. That kind of large scale fraud, in concert with the Chinese government, makes me seriously question any Chinese based investments. And I find the entire situation as frustrating as trying to figure out if my second daughter is lying. For the time being, I am going to wait. Patience is a virtue.